The Best Strategy To Use For Estate Planning Attorney

Table of ContentsThe Best Strategy To Use For Estate Planning Attorney5 Simple Techniques For Estate Planning AttorneyA Biased View of Estate Planning Attorney9 Simple Techniques For Estate Planning Attorney

Your attorney will likewise aid you make your documents official, scheduling witnesses and notary public signatures as needed, so you do not need to stress over attempting to do that last action on your very own - Estate Planning Attorney. Last, yet not the very least, there is beneficial comfort in developing a partnership with an estate preparation lawyer that can be there for you later onMerely placed, estate preparation attorneys provide worth in several methods, far beyond just giving you with published wills, counts on, or other estate intending records. If you have concerns about the procedure and desire to find out more, call our workplace today.

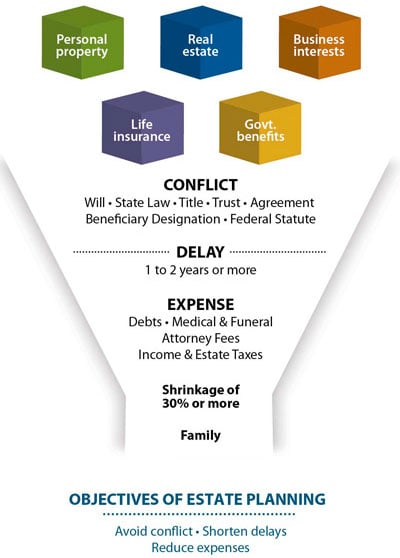

An estate planning attorney aids you formalize end-of-life decisions and lawful files. They can establish wills, develop counts on, create healthcare directives, develop power of attorney, develop succession plans, and much more, according to your wishes. Collaborating with an estate preparation lawyer to complete and manage this lawful paperwork can aid you in the complying with 8 areas: Estate intending attorneys are experts in your state's depend on, probate, and tax legislations.

If you do not have a will, the state can determine exactly how to divide your possessions among your beneficiaries, which could not be according to your desires. An estate preparation attorney can aid organize all your lawful documents and distribute your properties as you wish, possibly avoiding probate. Lots of people prepare estate preparation documents and afterwards forget them.

Getting My Estate Planning Attorney To Work

Once a client passes away, an estate plan would determine the dispersal of properties per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these choices might be delegated the near relative or the state. Tasks of estate coordinators include: Creating a last will and testament Setting up count on accounts Naming an executor and power of lawyers Recognizing all recipients Calling a guardian for minor children Paying all financial obligations and lessening all taxes and lawful costs Crafting directions for passing your values Establishing choices for funeral setups Wrapping up directions for care if you become unwell and are incapable to choose Obtaining life insurance, disability revenue insurance coverage, and long-lasting care insurance policy A great estate plan should be upgraded consistently as customers' financial scenarios, individual motivations, and government and state legislations all evolve

Similar to any type of profession, there are attributes and skills that can aid you accomplish these objectives as you collaborate with your clients in an estate coordinator role. An estate preparation profession can be appropriate for you if you possess the following qualities: Being an estate planner suggests thinking in the lengthy term.

The Estate Planning Attorney Ideas

You should help your client anticipate his/her end of life and what will the original source certainly take place postmortem, while at the very same time not house on somber ideas or emotions. Some clients may become bitter or anxious when pondering fatality and it might fall to you to help them through it.

In the event of fatality, you might be expected to have various conversations and transactions with surviving relative concerning the estate strategy. In order to succeed as an estate coordinator, you might require to walk a great line of being a shoulder to lean on and the individual relied on to communicate estate preparation issues in a timely and professional manner.

tax code transformed thousands of times in the one decade between 2001 and 2012. Anticipate that it has go now actually been changed better ever since. Depending upon your customer's financial earnings brace, which may progress toward end-of-life, you as an estate coordinator will certainly have to keep your customer's assets in full lawful conformity with any type of regional, government, or international tax obligation regulations.

Not known Incorrect Statements About Estate Planning Attorney

Getting this accreditation from organizations like the National Institute of Certified Estate Planners, Inc. can be a strong differentiator. Being a member of these specialist teams can verify your skills, making you much more attractive in the eyes of a potential customer. In enhancement to the emotional reward of helping customers with end-of-life preparation, estate coordinators delight in the advantages of a steady earnings.

Estate planning is a smart point to do no matter your current wellness and monetary status. Nevertheless, not so several individuals know where to begin the procedure. The very first important point is to hire an estate preparation attorney to help you with it. The adhering to are five advantages of dealing with an estate preparation attorney.

The percentage of individuals who do not know exactly how to get a will has actually boosted from 4% to 7.6% because 2017. A seasoned attorney recognizes what information to consist of in the will, including your beneficiaries and special factors to consider. A will shields your family from loss due to immaturity or disqualification. It likewise provides the swiftest and most efficient approach to transfer your possessions to your recipients.